December labour demand was lower than in previous years but labour shortages are still supporting activity – REC

- TEAM News

-

Jan 16

- Share post

December labour demand was lower than in previous years but labour shortages are still supporting activity – REC

- The number of active postings in the month of December 2023 was 1,710,492, a 24.3% decrease from the month before (November 2023) and a 32% decrease from December 2022 (2,516,973). There were 2.8 million active vacancies in the month of December 2021.

- Notable increases in adverts for prison service officers (+34.7%), authors, writers, and translators (+10.3%) and air transport operatives (+4%).

- In December 2023 Tower Hamlets (-7.7%), Haringey and Islington (-11.0%) and the Orkney Islands (-12.0%) had the softest decline in job postings when compared to November 2023.

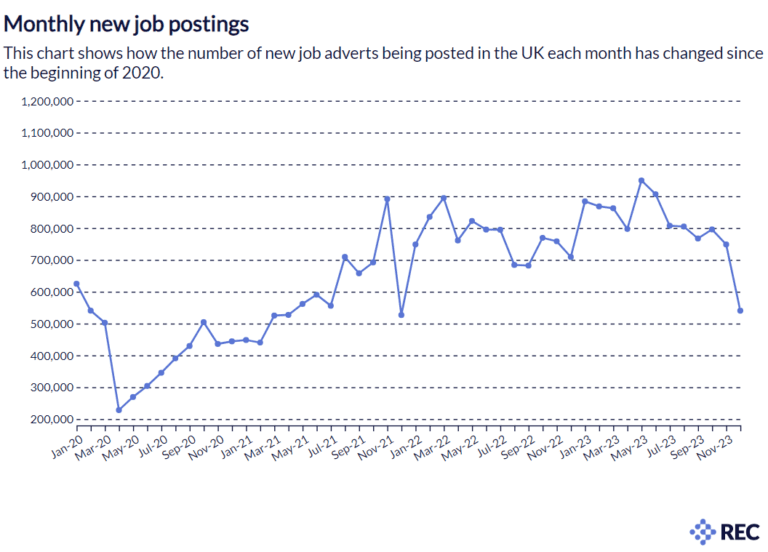

- There were 656,481 new job postings in December 2023 – a 27.7% decrease from the month before and a 27% decrease from December 2022 (899,049).

Despite falls relative to previous years, demand overall is still substantial, with the latest Recruitment & Employment Confederation (REC) and Lightcast Labour Market Tracker showing 1.7 million active job postings in December.

December is always a quiet month for recruitment, as Christmas hiring is generally completed and clients tend to postpone new activity into January, so the fall in posting numbers from November is no surprise. By contrast, the like-for-like comparison with the previous two Decembers, which came amid the post-pandemic sugar rush of hiring, emphasise the sequential slowing of the market in 2023.

REC Chief Executive Neil Carberry said:

“It is little surprise that jobs postings were muted in December because employers tend to have completed Christmas hiring by November, and then postpone new activity until the new year.

“The labour market weakened across 2023, especially for permanent roles. But it did so from a very high base. Comparing with previous Decembers, we can see a significant fall from the levels of activity in previous post-pandemic festive periods. It is important to remember that activity levels overall remain relatively high by comparison to pre-pandemic norms, and unemployment is low. There remains opportunity out there for jobseekers, especially in growing sectors.

“Anecdote and client survey data suggests there is hope for more growth in the market this year. As the economy grows, businesses will be looking to government to use the Spring Budget to unlock labour supply with action from welfare-to-work programmes to skills reform and a more sensible debate on immigration.”

Neil Carberry added:

“Uncertainty about the economy this year means we must make sure we support young people as they leave education. This must include rethinking the Apprenticeship Levy to re-focus levy money on 16–24-year-olds and those most in need – and more flexibility so that businesses can use it for high quality shorter training courses that will help plus skills gaps.”

Occupations with notable increases in adverts in December 2023 include prison service officers (+34.7%), authors, writers, and translators (+10.3%), air transport operatives (+4%) and speech and language therapists (+3.0%). Psychotherapists and cognitive behavioural therapists (-3.7%), dental nurses (-6.4%) and childminders (-6.6%) follow with the softest declines in job postings this month.

Manual labour roles were not particularly in demand during the December timeframe, with painters and decorators (-41.1%), packers, bottlers, canners and fillers (-40.5%) and road transport drivers (-40.2%) showing the lowest growth in job adverts.

When looking at the top ten counties/unitary authorities for growth in active job postings, five were based in London. This suggests a more encouraging trend for the capital’s job market and economy than reported in alternative recent jobs surveys.

Of the bottom ten areas with the lowest growth in active job postings, five were in Scotland and four were in Northern Ireland. This chimes with the REC/KPMG Scotland Report on Jobs which found that overall demand for staff weakened further, with both permanent and temp vacancies declining markedly in December.

Across the UK, Tower Hamlets (-7.7%), Haringey and Islington (-11.0%) and Orkney Islands (-12.0%) had the softest decline in job postings when compared to November 2023. Belfast (-34.2%), Fermanagh and Omagh (-34.3%) and East Dunbartonshire (-41.5%) all accounted for the sharpest decline in job postings.

Ends

Notes to editors:

- The REC has been analysing weekly and monthly data comparisons in parallel for the final months of 2023 to assess ways of improving the robustness of our analysis. Consequently, we will switch to comparing monthly rather than weekly data on a permanent basis from January 2024.

The LMT will also move from analysing Standard Occupational Classification (SOC) 2010 to the revised SOC 2020. The main areas of change from the previous classification are:

- A review of the classification of roles as professional or associate professional

This means that occupations such as Paramedics, Multimedia Designers, Investment Analysts, and Taxation Experts, which were part of the “Associate Professional or Technical” classification in SOC 2010, have been reclassified as “Professional” occupations in SOC 2020. - The reclassification of occupations associated with information technologies

This means that the growth in IT roles over the last decade or so has now been recognised by the creation of new unit groups such as Cyber Security, Quality and Testing, Networks, Web Design, Database Administrators, and IT Trainers. - Disaggregation into less heterogenous unit groups

This includes the creation of a separate role for Logistics Management; distinguishing General Medical Practitioners from Specialist Medical Practitioners; a breakdown of nursing roles; and more detail on storage and warehouse roles. - Overall, the new SOC 2020 classification system is more granular, with 43 more occupations at the 4-digit level than the 2010 version. This means that the REC can provide better and more up-to-date information, based on both the 43 the new classifications and the reviewed classifications.

- A review of the classification of roles as professional or associate professional

- The Labour Market Tracker is produced by the REC in partnership with Lightcast, using their Job Postings Analytics data which is harvested from tens of thousands of job boards. Data was harvested in December 2023. For more details, see the attached annexes which, in league table format, detail the top and bottom ten county/unitary authorities for growth in job postings and growth by occupation type.

- ‘Active’ job postings are those which were live online during the specified time period. ‘New’ job postings are those which were added to the active stock during the specified time period.